Welcome back to Oh My Rug, where we expose the biggest rugs, scams, and ironies in the crypto world. Today, let’s talk about the biggest silent whale in the game—the U.S. government.

Yes, the same people who spent years warning us about “the dangers of crypto” now sit on one of the largest Bitcoin holdings in the world. And how did they get all that sweet, sweet digital gold? Did they DCA into every Bitcoin dip? Did they ape into memecoins at the right time? Nope. They just took it.

Welcome to the ultimate government-funded crypto portfolio, featuring hits like Silk Road confiscations, FTX’s stolen funds, and some good old-fashioned centralized seizures. Let’s break it down.

How the U.S. Government Became the Biggest Crypto Whale Without Buying a Single Coin

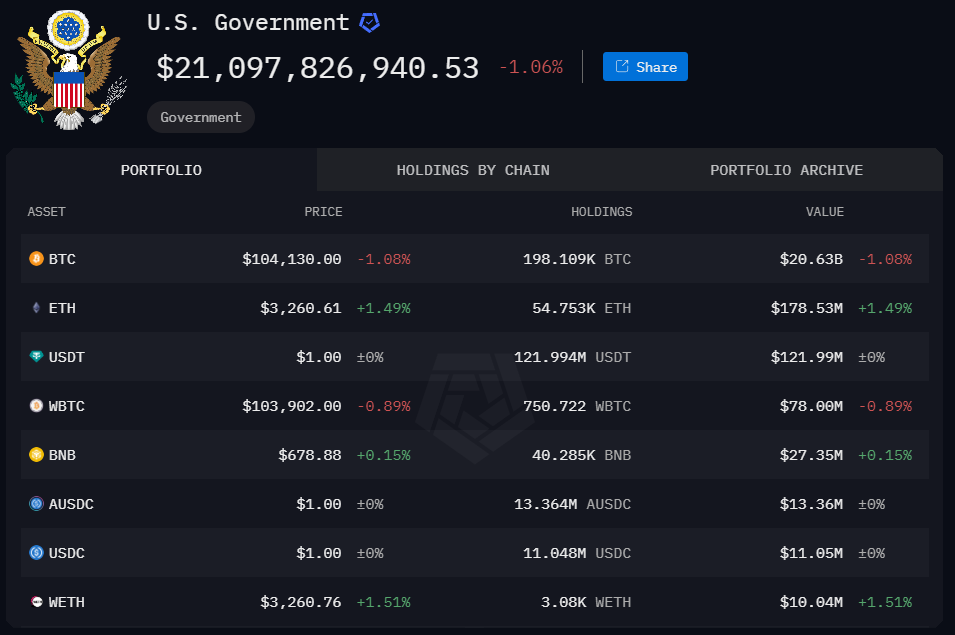

If you check the on-chain data (thanks to Arkham Intelligence), the U.S. government has an absolutely insane amount of crypto under its control. But unlike your favorite crypto whale who got lucky trading memecoins, the Feds didn’t have to risk anything. They just took what wasn’t theirs, and now they sit pretty on billions in confiscated Bitcoin.

Step 1: Take Down Silk Road, Keep the Bitcoin

First, let’s go back to the original crime scene: Silk Road. The dark web marketplace that Ross Ulbricht created was the place to buy and sell whatever you wanted—no questions asked. Until, of course, the U.S. government asked.

Ross got the full “example-making” treatment:

- Double life sentence + 40 years—because, clearly, running a website is worse than actual violent crimes.

- All Silk Road funds seized—because the government suddenly cared about decentralized finance.

- 50,676 Bitcoin (worth over $3.36 billion) confiscated—and instead of returning them to the people, the U.S. decided hodling was the right move.

The Lesson? If you’re going to build a black-market empire, maybe use Monero next time.

Step 2: The FTX Disaster—From Sam’s Pockets to Uncle Sam’s Wallet

Next, we have Sam Bankman-Fried, aka SBF, aka “Trust me, bro” incarnate.

FTX was supposed to be the future of crypto, but instead, it was just the future of how to lose $32 billion overnight. The U.S. government swooped in and said, “We’ll take that, thank you very much.”

- Seized from SBF: $700 million in assets (including crypto).

- Confiscated FTX customer funds—because who cares about returning it to actual users?

- FTX investors left holding the bag while the government pocketed the loot.

And now? Sam’s family is lobbying for his release—because apparently, if Ross Ulbricht gets out, “crypto equality” means Sam should get out too. Right.

Step 3: Ross Gets Free, Sam Wants a Turn

Here’s where the story takes a plot twist worthy of a Netflix special:

- Ross Ulbricht was pardoned by Donald Trump in January 2025, sparking cheers from the “Free Ross” movement.

- Ross’ Bitcoin bag? Gone. The U.S. had already dumped his assets, so he reentered the world broke AF—except for a rumor that he lost some of his freedom money gambling on shitcoins on Pump.fun. Yes, you heard that right.

- Sam’s family now demands justice, claiming that if Ross gets out, so should our little boy genius Sam.

Final Boss Level: The U.S. Government’s Bitcoin Treasury

Right now, the U.S. government’s Bitcoin holdings make it one of the biggest whales in the world. And unlike the degens who buy, trade, and sell, the government just seizes and stacks.

How they got their Bitcoin:

- Confiscating from Silk Road;

- Rugging FTX investors;

- Seizing “criminal” wallets.

What Can We Learn From This?

- The government FUDs crypto publicly but secretly loves it.

- If you hold Bitcoin long enough, the U.S. might just take it from you.

- If you get caught, your crypto isn’t yours anymore—it’s Uncle Sam’s now.

At the end of the day, the U.S. government might be the biggest rugger of them all—they FOMO into confiscated Bitcoin, dump it at the wrong time, and then tell everyone that crypto is dangerous.

Stay safe out there, and remember: not your keys, not your bitcoins – Andreas Antonopoulos.

What do you think? Should Sam be freed? Was Ross’ pardon the right move? And more importantly—how long until the U.S. government does its own ICO? Let’s discuss in the comments!

This article is based on real events and references public records as of January 2025.